The break-even point is essentially your minimum target to attain. Once this target is reached, and assuming your mix of fixed and variable costs hasn’t changed, any additional sales will generate a profit. To understand at a high level what that number is, is important, because it can then be broken down into units, products or service packages that are need to be produced and sold to cover your costs.

By default, it forms the basis of your first and ongoing plans. It’s a disciplines all business owners should master.

Why is Break-even point so important?

- It gives you a point of focus, your minimum financial & operational performance level.

- It provides an insight into the characteristics of your true cost base, which costs are fixed and which vary depending on your level of income or production.

- It provides an opportunity to review what optimum mix of products or services works for your business.

- It highlights the financial performance standards that need to be reached to start making money.

- It forms the basis for key pricing decisions and volume considerations in running your business.

- Its an important consideration when looking at new investment and the opportunities that may bring.

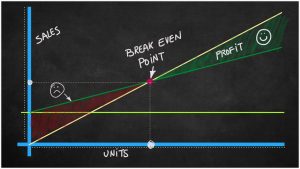

So what is break even?

In simple terms, the break-even point refers to the level of revenue needed to cover your total business costs over a specific period of time. So as a starting point for any business you should know and understand what that break-even point is in your business.

But you need to dig a little deeper to fully understand the cost drivers of your business in order to better understand the fluctuations that may occur in your break-even point as and when changes occur that impact your business operation. The changes could be to your product or service mix, or to your resourcing or to other parts of your operation. Some of these changes will be by choice, i.e. efficiency improvements you instigate, while others could be forced on you through needing to change suppliers or supply channels, or even move your business’s operations.

You need to work out at what point will the revenue you generate cover all your costs – that is both your fixed and variable costs. It’s thereafter that you start making a profit, assuming that there is no addition to your fixed costs or any adjustment needed to your variable costs, i.e. the break-even point will increase when the variable expenses increase without a corresponding increase in your selling price.

Fixed Costs

Typically the fixed costs of a business relate to expenses such as rent, administration costs, insurance, IT costs and some marketing costs. These costs generally remain constant and aren’t directly related to the process of generating revenue.

Variable Costs

Typically these are costs that are directly related to generating sales such as cost of products to sell, direct labour, commissions earned on sales, and costs of production and distribution. They are costs that vary depending on the volume of production, sales or services.

A company with many products or services should be able to understand the overall impact on the break-even point when the mix of products or services changes. For example, if a large proportion of lower contribution margin products (selling price minus variable expenses) are sold, the break-even point will require a greater number of units sold than if selling higher margined products or services.

How do you calculate the break-even point in terms of sales?

First determine your fixed costs. The higher your fixed costs = a higher break even point.

Then determine what variable costs you will need to incur to acquire, produce or sell products and services.

You then need to assess what price the goods or services should be sold at, accounting for what the market can tolerate.

You can then work out how many units you need to sell to cover your total costs, i.e. your break-even point. Thereafter, the marginal cost of producing extra products or generating extra sales is all that needs to be covered in order to generate a profit.

So where is this leading you to?

You need to keep on top of this part of your business operation. This is a discipline that needs to be embedded in your business and regularly (at least quarterly) reviewed to ensure that your cost assumptions have not materially changed. If they have then it creates an opportunity to review your pricing to determine whether those costs could and should be passed onto your customers. The more volatile your supply chain, the more often you need to review your costs and align your pricing.

It’s not uncommon for costs to creep up all over your business operation. By being disciplined and regularly reviewing your fixed and variable costs, you can quickly assess the impact those changes have on your break even position and make conscious decisions on whether to absorb or pass on costs by either increasing volumes or prices.

Do you need assistance calculating your break even point and gross margins? Also, If you need an accountant in Auckland – feel free to reach out.